Student loans have become a common way for individuals to finance their higher education. While obtaining a degree is vital for personal and career growth, paying off those loans can be overwhelming. However, there are several repayment options available to help ease the burden of student loan debt. In this article, we will explore these options and discuss how they can benefit borrowers.

1. Standard Repayment Plan

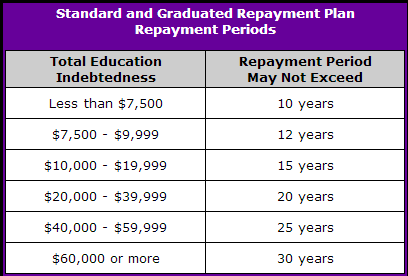

The standard repayment plan is the most common option for student loan repayment. Under this plan, borrowers make fixed monthly payments for a period of 10 years. This option ensures that the loan is paid off in a reasonable timeframe and minimizes the overall interest paid. It is suitable for individuals who can afford higher monthly payments.

2. Graduated Repayment Plan

The graduated repayment plan is an alternative option for borrowers who anticipate a higher income in the future. With this plan, monthly payments start off lower and gradually increase every two years. This allows borrowers to manage their finances during the early stages of their careers when their income may be relatively lower. The graduated plan is usually spread over a 10-year period.

3. Income-Driven Repayment Plans

Income-driven repayment plans are designed to make loan payments more affordable for borrowers who have a low income or are experiencing financial hardship. These plans calculate monthly payments based on the borrower’s income and family size. There are different income-driven plans available, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans offer extended repayment periods ranging from 20 to 25 years and offer loan forgiveness after the specified timeframe.

4. Loan Consolidation

Loan consolidation is another option available to borrowers who want to simplify their repayment process. It involves combining multiple federal loans into a single loan with one monthly payment. Consolidating loans can help borrowers reduce the number of payments they have to make each month and may offer a fixed interest rate. However, it’s important to note that loan consolidation may increase the total interest paid over the life of the loan.

5. Loan Forgiveness and Discharge Programs

Loan forgiveness and discharge programs provide relief to borrowers who meet certain eligibility criteria. These programs can forgive a portion or the entire remaining loan balance. There are various forgiveness programs available, such as Public Service Loan Forgiveness (PSLF) for individuals working in public service or non-profit organizations, Teacher Loan Forgiveness for teachers in low-income schools, and Perkins Loan Cancellation for specific professions or volunteer services.

6. Refinancing

Refinancing is an option for borrowers who have good credit scores and want to change the terms of their loans. By refinancing, borrowers can secure a lower interest rate, reduce monthly payments, or shorten the repayment period. However, it’s essential to evaluate the terms and conditions of the new loan to ensure that refinancing will have long-term benefits rather than additional costs.

Conclusion

Managing student loan debt is crucial for individuals seeking higher education. Understanding the various repayment options available can help borrowers choose the most suitable plan based on their financial situation. Whether it’s a standard repayment plan, income-driven plan, loan consolidation, loan forgiveness program, or refinancing, individuals should carefully analyze the terms and consider seeking professional advice when necessary. By choosing the appropriate repayment option, borrowers can effectively tackle their student loan debt and pave the way towards a financially secure future.