Retirement is a stage in life that everyone should look forward to. However, to ensure a comfortable retirement, it is essential to start saving early and utilize the right strategies and accounts. This article will discuss some effective strategies for saving for retirement and highlight some popular retirement accounts available to individuals.

1. Start Early

One of the most important strategies for saving for retirement is to start as early as possible. The power of compounding interest can work wonders when given enough time. By starting early, even small contributions can grow significantly over a long period.

Utilize automatic paycheck deductions or set up automatic transfers from your checking account to a retirement savings account to ensure consistent savings.

2. Set Clear Retirement Goals

Having clear retirement goals helps you determine how much you need to save and the timeframe you have to achieve your goals. Calculate your desired retirement income based on your current lifestyle and estimate your expenses during retirement. This will provide a target savings amount to work towards.

Consider factors such as healthcare expenses, inflation, and desired lifestyle changes when setting your retirement goals.

3. Take Advantage of Employer-Sponsored Retirement Plans

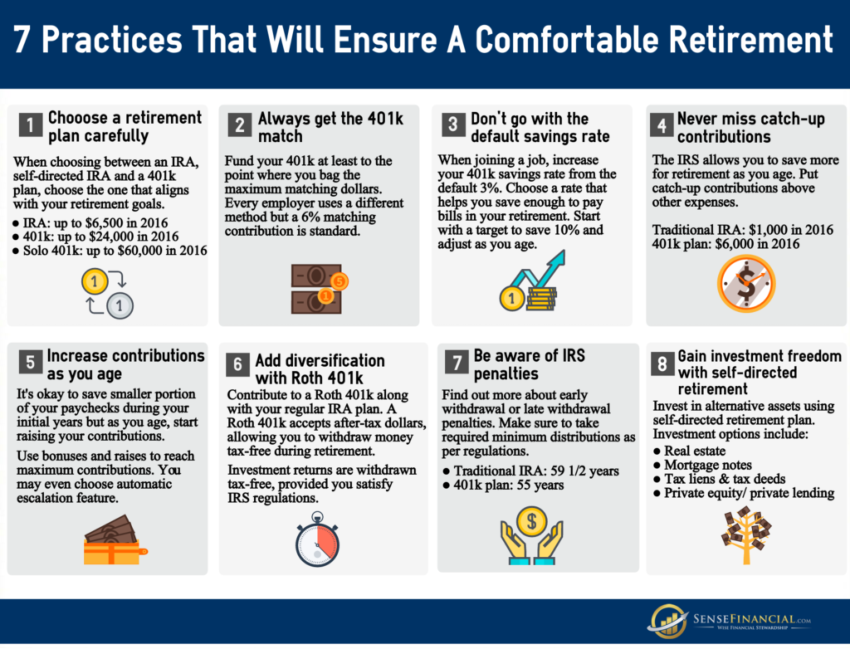

Many employers offer retirement plans such as 401(k)s or 403(b)s. These plans often include employer matching contributions, which essentially means free money. Take full advantage of these plans by contributing enough to receive the maximum employer match.

“If your employer offers a 50% match on contributions up to 6% of your salary, make sure you contribute at least 6% to receive the full matching contributions,” said financial advisor John Smith.

4. Diversify Your Investment Portfolio

Don’t rely solely on one type of investment. Diversifying your investment portfolio helps manage risk and increase the potential for higher returns. Consider investing in a mix of stocks, bonds, mutual funds, and other investment vehicles to spread out risk and potentially maximize returns.

5. Consider Opening an Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is a popular retirement savings account for individuals. There are two main types of IRAs: Traditional IRAs and Roth IRAs.

Traditional IRA: Contributions to a Traditional IRA are tax-deductible, and earnings grow tax-deferred until withdrawals are made during retirement.

Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals during retirement are tax-free.

Choose the IRA type that aligns with your tax situation and retirement goals.

6. Maximize Contributions

Try to maximize your annual contributions to retirement accounts. The more you can contribute, the more substantial your retirement savings will be. Be aware of the contribution limits set by the Internal Revenue Service (IRS) for each retirement account type and adjust your contributions accordingly.

7. Reassess and Adjust Your Retirement Plan Regularly

As life circumstances change, it is important to reassess and adjust your retirement plan accordingly. Review your retirement goals, investment strategy, and contributions at least once a year. If necessary, make changes or seek advice from a financial advisor to ensure you stay on track.

Conclusion

Saving for retirement should be a top priority for individuals of all ages. By starting early, setting clear retirement goals, taking advantage of employer-sponsored retirement plans, diversifying investments, utilizing retirement accounts, maximizing contributions, and regularly reassessing your plan, you can ensure a comfortable retirement. Remember, it’s never too late to start saving, but the earlier you begin, the more time your money has to grow.