When it comes to managing our finances, credit scores play a crucial role in determining our financial health. A credit score is a numerical representation of an individual’s creditworthiness, indicating how likely they are to repay their debts on time. Lenders, landlords, and even potential employers rely on credit scores to assess the risk involved in extending credit or entering into financial agreements with an individual. In this article, we will explore the importance of credit scores, factors that affect them, and tips to improve your financial health.

The Importance of Credit Scores

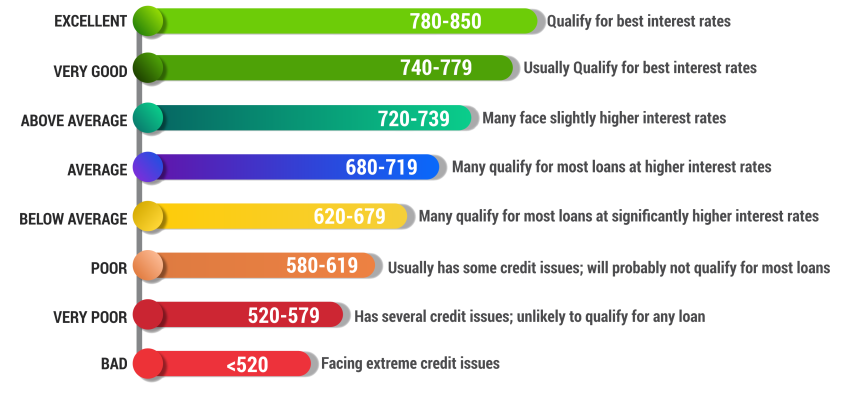

A good credit score opens doors to various financial opportunities. It allows individuals to secure loans, such as mortgages or auto loans, at favorable interest rates. Higher credit scores also result in lower insurance premiums and better rental terms. On the other hand, a poor credit score can limit your financial options and lead to higher interest rates, difficulty in renting or purchasing a home, increased insurance premiums, and even denials for job offers.

Factors Affecting Credit Scores

Several factors influence credit scores, and understanding them is essential for improving your financial health. The most crucial factor is payment history, which accounts for approximately 35% of your credit score. Consistently making on-time payments positively impacts your credit score, while late payments or defaults can severely damage it. The second significant factor is credit utilization, which represents the amount of credit you currently use compared to your total available credit. Keeping your credit utilization below 30% is generally recommended for maintaining a healthy credit score.

The length of your credit history also affects your credit score. Lenders prefer individuals with a longer credit history as it provides them with a better understanding of their creditworthiness. Additionally, having a diverse mix of credit, such as a combination of credit cards, loans, or mortgages, can positively impact your credit score.

Other factors that may influence credit scores include the number of recent credit inquiries, the total amount of debt, and the number of open credit accounts. It is crucial to regularly monitor these factors and ensure they are within a healthy range to maintain or improve your credit score.

Tips to Improve Your Financial Health

Improving your financial health requires diligent effort and responsible financial behavior. Here are some practical tips to help you raise your credit score and enhance your overall financial well-being:

Create a Budget and Stick to It

Start by evaluating your income and expenses to create a realistic monthly budget that covers your necessities while leaving room for saving and debt repayment. Stick to this budget religiously and avoid unnecessary spending.

Pay Your Bills on Time

Make timely payments for all your bills, including credit card bills, loans, and utility bills. Late payments can harm your credit score and incur unnecessary fees and penalties.

Reduce Your Debt

Develop a plan to reduce your existing debt systematically. Begin by paying off high-interest debt first, such as credit card debt. Keep your credit utilization low, ideally below 30% of your available credit.

Avoid Opening Unnecessary Credit Accounts

While a diverse mix of credit can benefit your credit score, avoid opening multiple credit accounts if you do not need them. Every credit inquiry can have a slight negative impact on your credit score.

Monitor Your Credit Report Regularly

Review your credit report at least once a year to ensure its accuracy. Report any errors or discrepancies to the credit bureaus to maintain an accurate representation of your credit history.

Build a Positive Credit History

If you are new to credit or working on rebuilding your credit, consider obtaining a secured credit card or becoming an authorized user on someone else’s credit card. Responsible use of credit and consistent, on-time payments can help establish or improve your credit history.

Seek Professional Help if Needed

If you are struggling to manage your finances or improve your credit score, do not hesitate to seek professional help. Credit counseling agencies and financial advisors can provide guidance tailored to your specific situation.

Conclusion

Keeping a good credit score is imperative for maintaining financial health. By understanding the factors that affect credit scores and implementing responsible financial habits, you can improve your creditworthiness and unlock various financial opportunities. Remember to regularly monitor your credit report and make necessary adjustments to ensure your financial well-being in the long term.