Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of any central authority, such as a government or financial institution. Understanding the basics of cryptocurrency is essential for anyone interested in this evolving financial landscape.

What is Cryptocurrency?

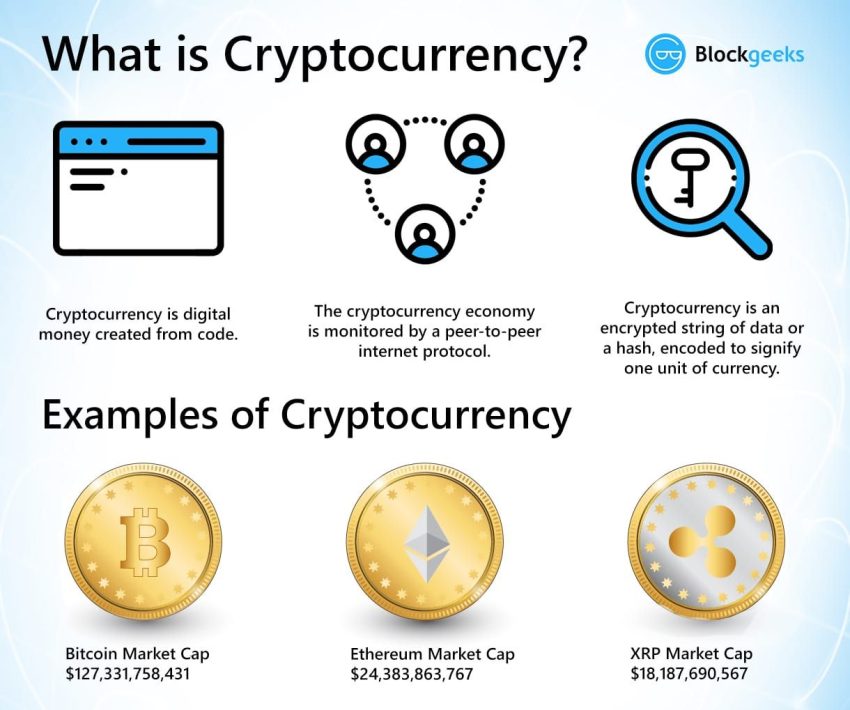

Cryptocurrency is a form of digital currency that uses cryptography to secure transactions, control the creation of new units, and verify the transfer of assets. It is decentralized, which means it is not regulated by a central authority. Bitcoin, created by an anonymous individual or group known as Satoshi Nakamoto in 2009, was the first and most well-known cryptocurrency. Since then, numerous other cryptocurrencies, including Ethereum, Ripple, and Litecoin, have emerged.

How Does Cryptocurrency Work?

Cryptocurrencies use decentralized ledger technology, known as blockchain, to record and verify transactions. Blockchain is a distributed and transparent digital ledger that securely records all transactions across multiple computers or nodes. These transactions are grouped into blocks and added to a chain of existing blocks, hence the name “blockchain.” Each block contains a cryptographic hash of the previous block, ensuring the integrity and immutability of the data.

Benefits of Cryptocurrency

There are several benefits associated with cryptocurrency:

Decentralization: Cryptocurrencies are not controlled by a central authority, such as a government or bank, making them immune to political or economic influences.

Secure Transactions: Cryptocurrency transactions are secured by cryptography, making them highly secure and nearly impossible to counterfeit.

Privacy: While transactions are recorded on the blockchain, users’ personal information is kept private, ensuring their anonymity.

Global Accessibility: Cryptocurrencies can be used for transactions across borders without the need for traditional banking systems, eliminating barriers and reducing costs.

Ownership and Control: Cryptocurrency users have complete ownership and control over their digital assets, eliminating the need for intermediaries.

Risks and Challenges

Although cryptocurrencies present various benefits, they also come with risks and challenges:

Volatility: Cryptocurrency prices can be highly volatile, resulting in significant price fluctuations and potential financial losses.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, with different countries adopting different approaches. This uncertainty can create challenges for individuals and businesses operating within the cryptocurrency space.

Security Concerns: While cryptocurrencies use advanced cryptography for security, they are not immune to risks such as hacking, phishing attacks, and scams. Users must take appropriate measures to protect their digital assets.

Adoption and Acceptance: Although cryptocurrencies have gained popularity, widespread adoption and acceptance across industries are still limited. This can hinder their mainstream use and potential as a global currency.

Conclusion

Cryptocurrency is a digital form of currency that operates independently of any centralized authority. It uses cryptography and blockchain technology to secure transactions and provide a decentralized and transparent system. While cryptocurrencies offer various benefits, such as privacy, security, and global accessibility, they also come with risks and challenges. Understanding the basics of cryptocurrency is crucial for anyone considering venturing into this emerging and ever-evolving financial landscape.